Porinju Veliyath 14th October 2022

"Puggy" Pearson was a legendary American professional poker player. He once said:

“Ain't only three things to gambling: knowing the 60-40 end of the proposition, money management, and knowing yourself.”

Same is true for the investing process, it is all about:

1. 60/40 odds – i.e., risk vs return odds of investments done

2. Money management – i.e., how one deals with cash, concentration, diversification, timing, leverage etc., and most importantly

3. Knowing thyself – which is all about understanding what drives an investor’s motivations and behaviour.

It is the third factor which sets tone for the first two. Any understanding or insight needs a “context”; and in investing this key “context” is the investor himself. In short one’s portfolio is very much a reflection of his/her personality.

For us at EQ, due to the fiduciary role taken up by us of managing money for others, it is our team that ends up becoming the “context”. After all it is the team that invests on behalf of all our varied set of investors. Each of our investor comes with a different “psychological” make up, driving them to varied expectations around returns, risk, timing etc. However, Team EQ must be “authentic” to our own “being” – and act like we do for our own capital. That’s the nature of fund management activity.

It is important from time to time to be candid about how we think and who we are so that all of you can assess our behaviour over time. It is the alignment of our behaviour with investors’ expectations that makes the process enduring and fruitful for both.

EQ has been inspired and influenced by two traditions:

· The long and deep tradition of “Value Investing”, and

· The tradition, topography, and ethos of Kerala.

Our core is embedded in these two cultures, and they very much define “who we are”. We have spoken about the value investing tenets that we adhere to in several past communications and would continue to re-iterate some of them time and again; this time let us spare some thought for our Kerala roots!

Our “organisational character” is nurtured by the greenery and serenity of Kerala - not by busy and buzzing streets of financial centres like Mumbai. To be honest, this has served us well over the past two decades - to hold our independence and courage on various challenging occasions.

“Adaptability” is a key virtue in markets

Nature thrives and rules in every nook and corner of Kerala, the God's own Country. Mother nature teaches us the lessons of “Adaptability”. From scorching summer heat to pouring monsoon showers, from the wild Arabian sea waves to the moody Western Ghats, life in Kerala is always about constant change and the only way to survive and thrive is by being adaptive. The economy and markets are no different, and the only way to remain relevant is to be “Adaptive”.

“Holistic Awareness” over specific expertise

Kalarippayattu, one of the oldest martial art forms, originated in the present-day state of Kerala around 3rd century BC. Often described as the mother of all martial arts, it is about synergizing the mind and body together to form a deft move; you master one move and then again move on to the next one and so on, in the end developing a “holistic awareness and holistic fitness” and not just focusing on any one part or aspect of the body. It’s difficult to describe Kalarippayattu techniques on paper, as it is a combination of so many moves together that requires daily discipline of routines and practices. But here is the key take away: Alertness with a holistic eye, trained day in day out with dedication and discipline, is what takes to be a prudent investor.

“Activity” is not a sign of prudence

Some of you have been continuously expressing the need for more “activity” in the portfolios. At times being “adaptive” and “alert” would also mean “doing nothing” adventurous and holding on to your horses so to speak. That gives fire power to act swiftly when favorable opportunities develop. An “Alert Pause in Posture” is a sign of strength, not weakness. We hold businesses with favorable growth opportunities, with adequate margin of safety, that are acquired at attractive prices; we do not see ourselves jumping from one boat to the other as we are not necessarily sailing through silent waters but may be a turbulent one.

Here is what we communicated March 2022:

…it is prudent and humbling to note that “No One Knows about Anything” during such turbulent phase. “Turbulence is scary but temporary” is the only rational thought to have as an investor…….We are very comfortable with portfolio of businesses we own. We see current decline in “Prices” as temporary and “Value” in underlying companies more enduring with passage of time.

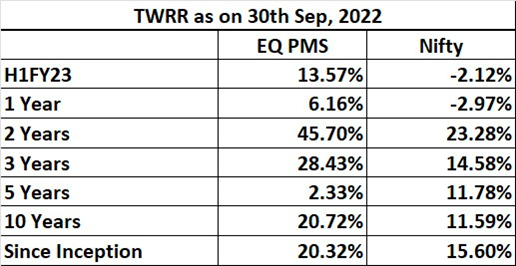

We did not panic on so called global risk nor we jumped too many ships to feel safe and our performance from April to September 2022 validates our behavior. From April to September 2022 EQ-PMS is up 13.57% vs Nifty decline of 2.12%. Clearly substantial reason for this performance is not due to general movement in markets but a reflection of value generated by businesses we held.

“Time” humbles us all.

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.” – Warren Buffet

No matter how honest and hardworking we are; mistakes are inevitable in the complex world of investing. We had our share of pain in 2017-18. We also acknowledge some investors who started the journey during those periods could yet be nursing wounds as indicated by the 5-year under-performance.

However, we have managed to substantially heal those past injuries and our conviction is that in the longer term the compounded returns for such investors will also reach a satisfactory CAGR number, as some of our current holdings mature to their real market values. Rushing to heal could be counterproductive at times. Time, discipline, and prudence are what will deliver desired results over time.

Sensible Investing is all about focusing your energy on what is “important, knowable and controllable”. And at times investors forget that most important, knowable and controllable factor is he himself. Sensible investing is sensible behaviour!

To conclude we would re-iterate with conviction the following:

- Macro concerns being discussed by one and all – geopolitical risks disrupting supply chains, currency volatility, run-away inflation, rising interest rates etc. are to a large extent being priced in by markets in our view. Indian economy has been resilient, Rupee depreciation is one of lowest compared to most nations, Indian markets have relatively outperformed, and from geopolitics standpoint too India has been differentiated positively.

- Base rate of equities doing well over long term is high. Base rate is also extremely high to get good returns when we have following factors in our favour at play: global advantages in emerging technologies, young population, strong and stable leadership, clean corporate balance sheet, recovering investment cycle, conducive policy framework and the current reasonable valuations…

- Our current set of holdings continues to exhibit strong or improving fundamentals and possess satisfactory margin of safety in our assessment. Price-Value gap in our holdings should help us earn very satisfactory returns going forward.

- There are enough pockets of value in the market, both within our existing holdings and outside, where we can venture into as and when additional capital is committed to us by our investors.

We wish all of you and your loved one’s happy festivities for the upcoming Diwali.

Regards and Happy Compounding!

Porinju Veliyath